And how the Supervity AP AI Employee delivers them with speed, accuracy, and real-time insight.

For years, Accounts Payable success was defined by speed, how quickly invoices were processed and how many could pass through without human touch. But in 2025, the real measure of success has changed.

CFOs aren’t just tracking how fast their finance teams close; they’re looking at how intelligently their operations run.

They want to know where exceptions are happening, how processes adapt in real time, and whether their automation delivers transparency as well as throughput.

The age of automation has evolved into an era of intelligent finance, and the Supervity AP AI Employee sits at the center of that shift.

It turns Accounts Payable from a back-office function into a dynamic intelligence layer that CFOs and finance leaders can finally see, measure, and trust.

It begins with visibility.

In the past, finance leaders relied on reports after month-end to gauge performance. Now, they expect to see what’s happening across every entity, every region, every moment.

That’s why Straight-Through Processing, the share of invoices that move automatically from receipt to payment, has become the modern AP standard. With Supervity, finance teams routinely achieve up to 75% STP within weeks, as the system learns from every transaction and continuously refines its logic.

But beyond the automation rate itself, CFOs can now see why invoices don’t flow straight through.

The Live Exception Analysis view surfaces the root causes of delays in real time, duplicates, mismatches, missing POs and allows leaders to drill into them instantly.

Every exception becomes an opportunity to improve, not a surprise waiting at close.

Speed still matters, but predictability matters more.

The best finance teams have replaced “fast” with “flow.”

Supervity’s Agentic AI orchestration layer creates that flow by routing, reconciling, and prioritizing invoices dynamically.

It understands which approvals can move forward with confidence and which need review, maintaining both accuracy and agility.

Across enterprise pilots, this has meant up to 90% faster invoice cycle times, but more importantly, smoother ones.

And when something slows down, finance doesn’t have to guess why.

The Workflow Bottleneck dashboard visualizes the average time invoices spend in each queue, highlighting process slowdowns before they affect liquidity or month-end close.

For CFOs, it’s no longer a postmortem, it’s a pulse.

ISO 27001, and GDPR badges below. Symbolizes accurate, auditable, and compliant Accounts Payable operations.

In every finance conversation, accuracy is still the baseline, but today it’s also a competitive advantage.

Even a one-percent error can distort reporting or delay audits.

That’s why the Transparent AI Engine within the Supervity AP AI Employee validates every line item against POs and receipts in real time, achieving 95%+ accuracy across invoice types and formats.

Every validation is captured in a complete, explainable audit trail aligned with SOC 2 Type II, ISO 27001, and GDPR standards.

Finance transformation has never been about removing people, it’s about amplifying them.

The Team Throughput view shows how many invoices each team member processes within a given period, helping leaders balance workloads and spot performance trends. Right alongside it, the Exception Rate

metric reveals recurring process breakdowns, helping the system, and the team learn with each cycle.

Right alongside it, the Exception Rate metric reveals recurring process breakdowns, helping the system, and the team learn with each cycle.

Over time, the AP AI Employee converts those human corrections into automation rules, reducing manual work by 50–70%.

The system doesn’t just run processes; it evolves with them.

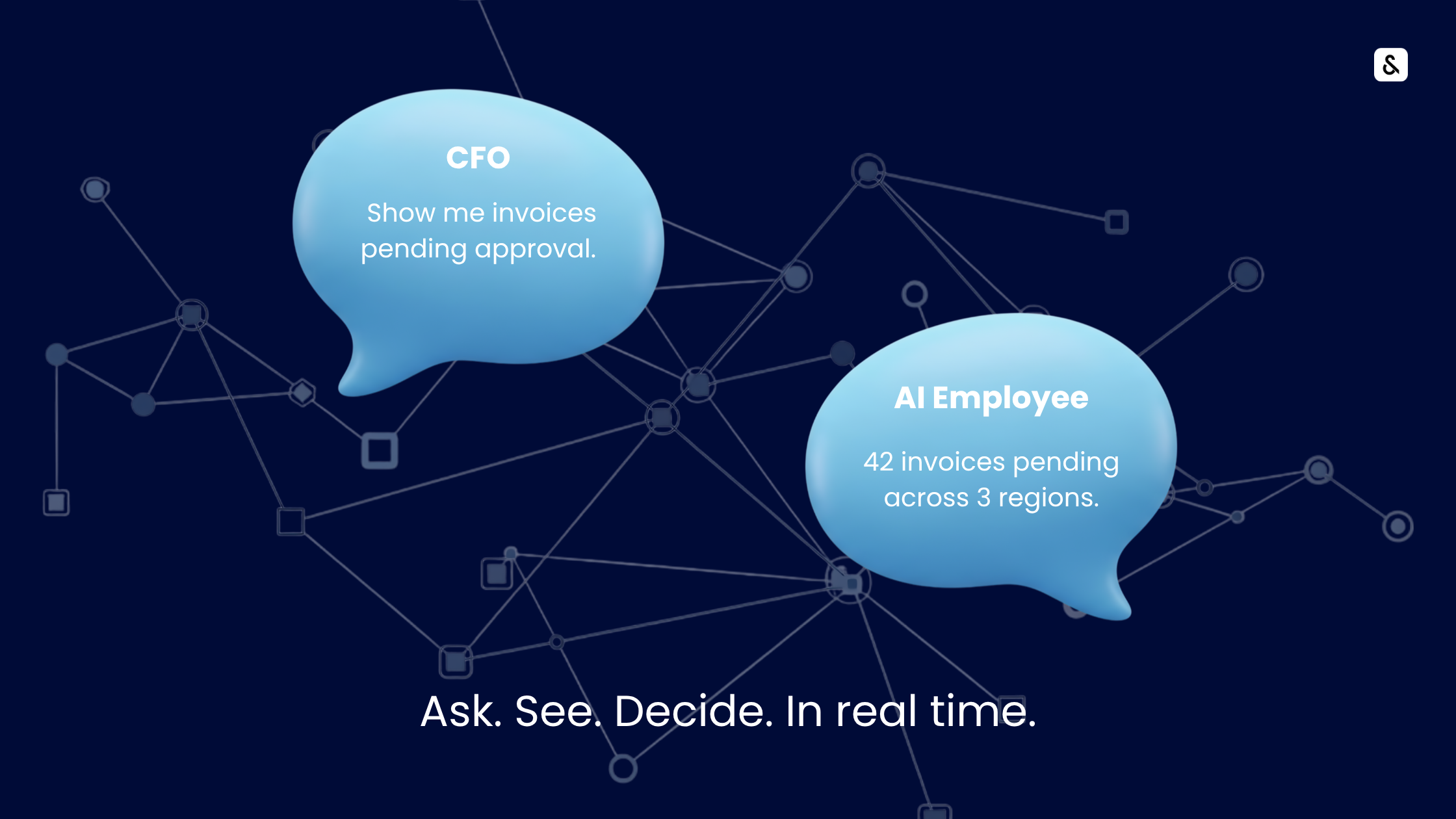

Finance leaders no longer wait for reports. They ask questions and expect answers in real time.

Through the Conversational AP Manager, a CFO can simply type:

“Show me invoices pending approval across North America.”

“What’s our DPO trend this quarter?”

The AI Employee responds instantly, pulling data directly from SAP, Oracle, NetSuite, Workday, and Microsoft Dynamics.

The result is full working capital visibility: total payables, exception patterns, and DPO trends available the moment they’re needed.

For the first time, CFOs can see their operational metrics and liquidity metrics as one continuous story.

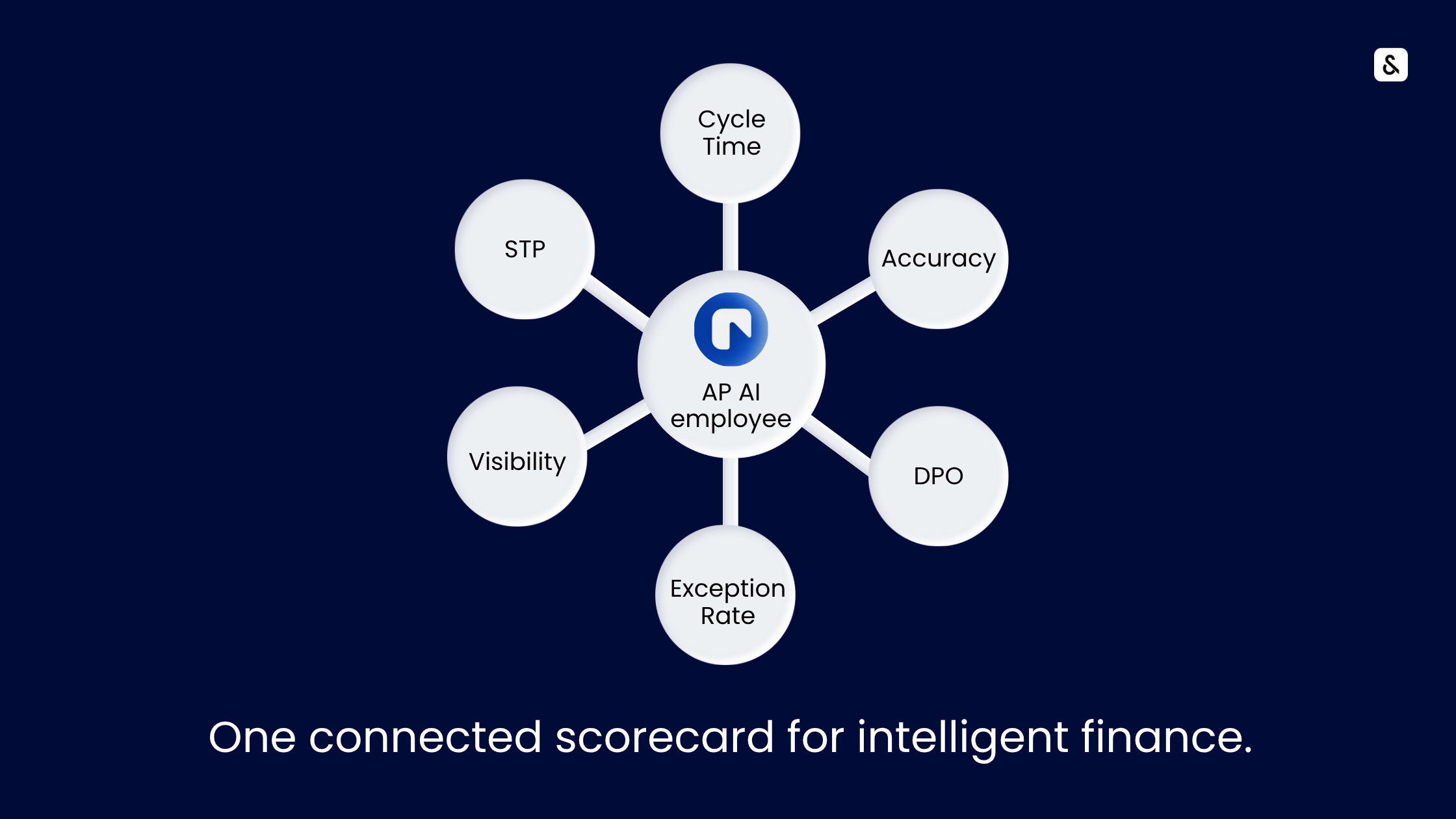

Every finance leader still tracks the essentials: Straight-Through Processing, Cycle Time, Accuracy, DPO, Exception Rate.

What’s new is how these numbers now connect and evolve together.

Supervity’s AI Employee for Accounts Payable brings them to life through:

Each metric is now a window into how intelligently the business operates, and a lever to improve it.

The most successful CFOs in 2025 don’t just automate; they understand. They manage not just efficiency, but intelligence, systems that learn, surface, and explain the data behind every payable.

The Supervity AP AI Employee turns those insights into measurable results: higher accuracy, lower intervention, faster cycles, and real-time visibility. Finance automation has moved beyond faster processing,

it’s now about seeing everything clearer.

With Supervity, that clarity is already here.

See how your finance team can achieve 95% accuracy, 75% STP, and real-time visibility, all within weeks.