When we first started showing the AP AI Employee to finance teams, the reactions were almost

identical – “Wait, this isn’t automation. This feels like another person in the team.”

That’s exactly what we wanted to hear.

Because the idea wasn’t to create a smarter bot or a faster workflow.

It was to build something that actually understands finance, not just processes it.

When we spoke to CFOs and AP heads, the themes were unmistakable:

Everyone wanted a single, intelligent layer of control – something that could see, decide,and act across

the entire invoice-to-pay lifecycle.

At the heart of this system is the AP Command Center – the brain of the AI Employee.It doesn’t just

automate tasks; it orchestrates outcomes.

The Command Center sees everything: invoices, POs, GRNs, exceptions, approvals,and payments

– all connected in one view.

It reasons through data, learns from past actions, and keeps the process flowing even when something breaks.

But the best way to understand it is to walk through a day in its life.

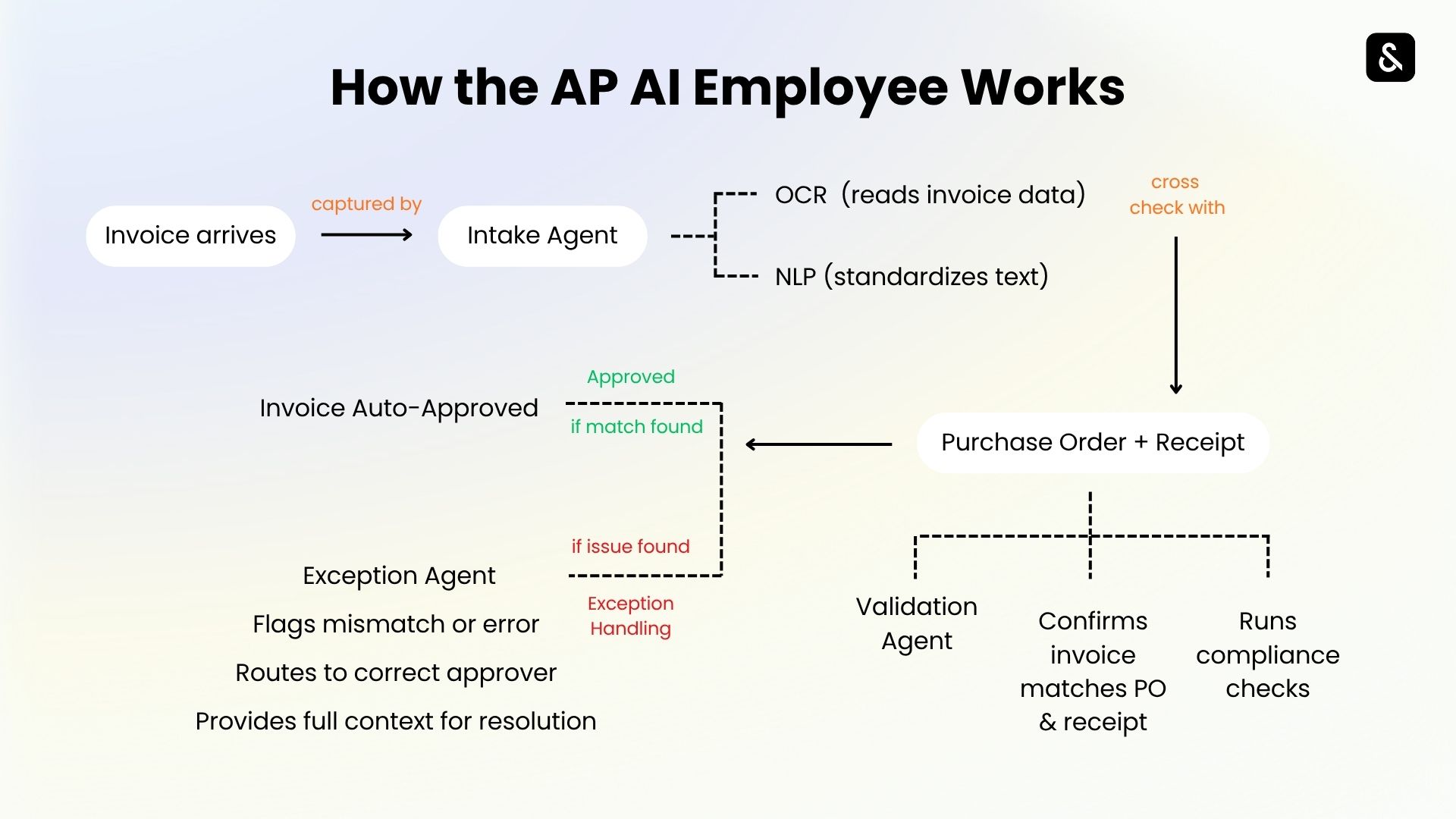

It begins with an inbox full of invoices – structured PDFs, unstructured scans, and emails with attachments.

The AP AI Employee reads them all instantly, extracting key details: vendor names, PO numbers, taxes, and terms.

No templates. No manual mapping.

Next, it verifies GRNs.

If a shipment has been partially received or a quantity doesn’t match, it doesn’t throw an error.

It flags the anomaly, checks prior trends, and predicts whether the mismatch is a process gap or an actual vendor issue.

Then comes matching

It aligns invoice lines with POs and receipts, intelligently

Tax mismatches, duplicates, and price changes are auto-corrected, not escalated.

If something truly needs review, it’s routed to the right approver, automatically.

Approvals aren’t just routed, they’re anticipated.

The system learns approval behavior and nudges actions before delays occur.

No reminders, no “stuck in workflow” tickets.

Once complete, the AI agents update audit logs, compliance records, and payment readiness in real time

– across every system.

What used to take days, now runs continuously, accurately, and autonomously.

It’s AP on autopilot but with full human oversight whenever needed

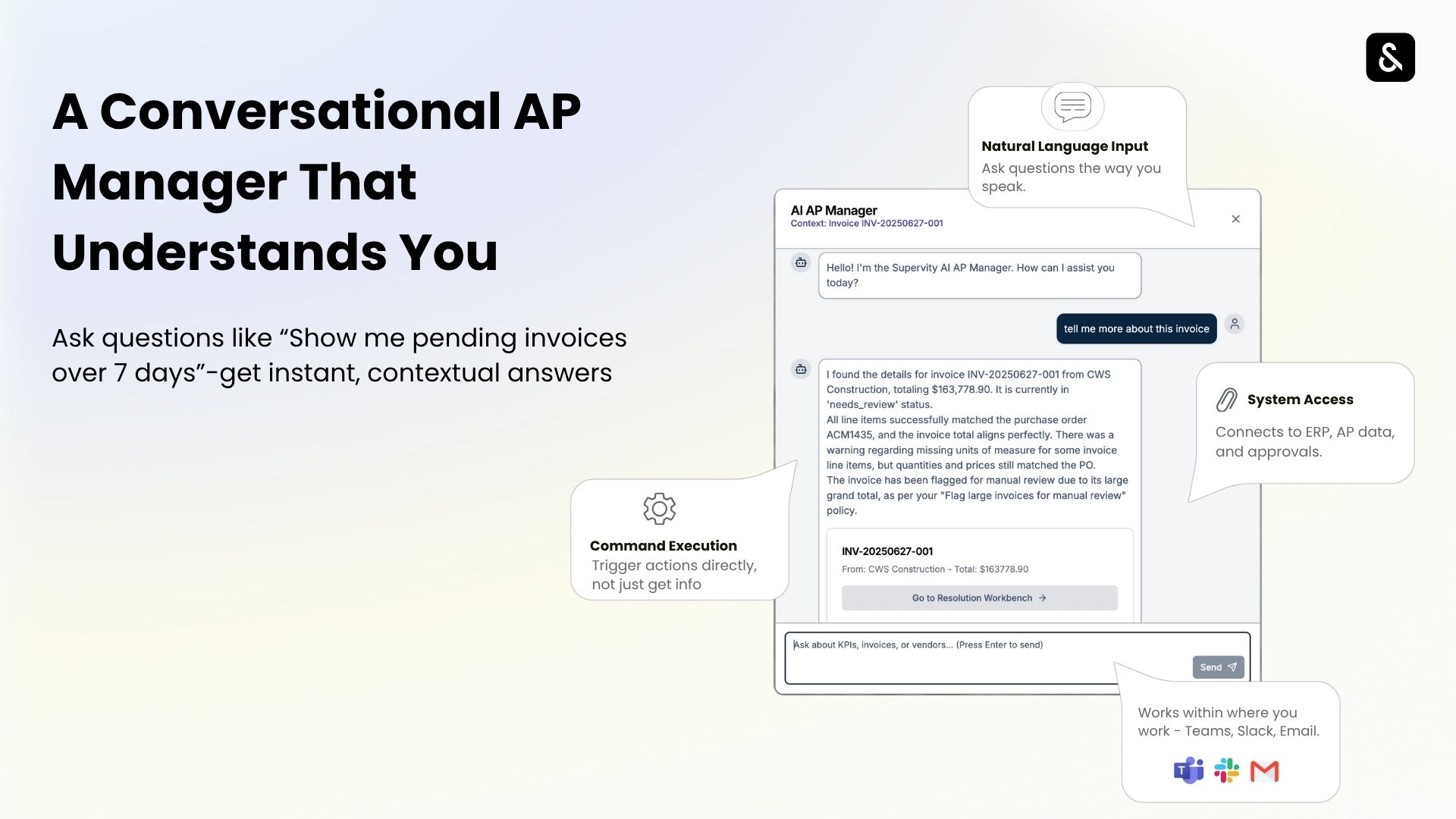

Every interaction with the AI Employee feels human.

Ask it:

“Show me invoices pending over 7 days.”

“Which vendor caused the most exceptions this month?”

“How many POs are pending GRN confirmation?”

You’ll get a reasoned answer –not just data, but insight.

It’s how finance teams move from dashboards to dialogue.

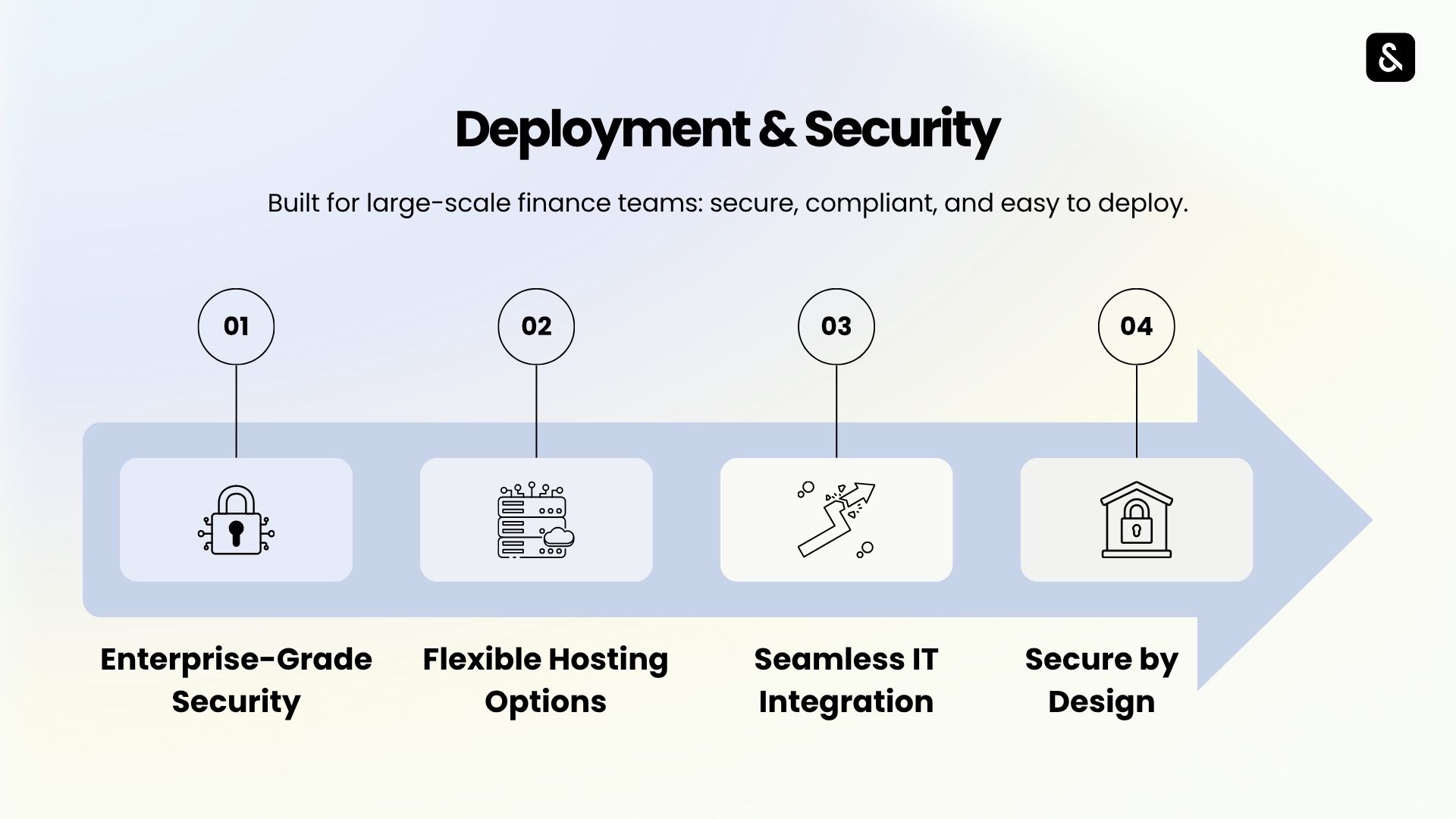

Every organization works differently.

That’s why the AP AI Employee lets you fine-tune business logic, define vendor-specific policies, and

create transparent audit rules, without writing a single line of code. It integrates seamlessly with SAP, Oracle,

and other ERPs while keeping data governance intact.

Enterprises using the AP AI Employee report:

The numbers tell one part of the story.

The real difference is in how finance feels – lighter, clearer, and in control.

The AP AI Employee is part of Supervity’s AI Workforce – a set of intelligent digital employees built for the

modern enterprise.

Each AI Employee specializes in a function – managing invoices, handling service requests, resolving IT issues,

or supporting HR operations.

They share one common design philosophy: to think, learn, and act alongside humans,not instead of them.

With the AP AI Employee, finance teams don’t just automate tasks – they gain a dependable partner that manages

processes, surfaces insights, and evolves with every transaction.

It’s how the future of work begins: one intelligent employee at a time.